The MorganAsh blog

Our views and comments on customer vulnerability, Consumer Duty and more.

New guidance puts customer vulnerability systems under the spotlight

The new vulnerability guidance from the Chartered Insurance Institute (CII) is a significant step forward for both the insurance and personal finance sectors – and offers much across all of financial services. It provides firms with clear and comprehensive guidance of what ‘good’ looks like when it comes to supporting vulnerable customers.

The new vulnerability guidance from the Chartered Insurance Institute (CII) is a significant step forward for both the insurance and personal finance sectors – and offers much across all of financial services. It provides firms with clear and comprehensive guidance of what ‘good’ looks like when it comes to supporting vulnerable customers. Just as important is the access to a clear action plan to help firms not only embrace, but embed the principles-based guidance of Consumer Duty – something that has been a real stumbling block for many.

Crucially, the guidance explains what this all means for the IT systems that underpin these processes to deliver the efficiencies that make Consumer Duty far easier and cheaper to achieve. Firms require clear structure and data that is both robust and consistent, to more readily enable detailed reporting backed by evidence. There’s no question that this requires technology – and the CII’s guidance serves to emphasise this.

Without such systems in place, firms are left data-poor – limited by inconsistent and subjective identification of vulnerable customers, delayed support pathways and insufficiently robust audit trails. Above all, customers face outcomes that fall far short of Consumer Duty. It’s about much more than achieving compliance though. Without the right technology, firms cannot understand customers well enough to unlock both the competitive advantages and commercial benefits of responding to their needs and delivering a greater service.

Leveraging the right technology

The CII has long documented the firms’ struggles to fully rise to the occasion, particularly while they transition away from more prescriptive regulation. It is well known that managing customer vulnerability is the hardest part of Consumer Duty. The FCA themselves has long advocated for technology adoption – to not just shore up, but to streamline vulnerability management.

After all, customer vulnerability is complex, dynamic and changes over time. And, given the increased scope of Consumer Duty, the tick-boxes and comment boxes of the CRMs of old are simply not up to the task. That’s why the CII’s new guidance puts significant emphasis on systems that can identify, record, monitor and report on customer vulnerability – and consumer outcomes – in an objective, consistent and structured manner.

While some have tried to ‘Frankenstein’ current systems, or build their own, the most efficient and cost-effective solution for firms is to adopt or integrate one of the purpose-built systems currently available.

A practical systems checklist

For firms looking at how they should invest in technology, the guidance provides a practical checklist to ensure that systems meet the required standards. The list is comprehensive, but is split into five key areas.

Firstly is identification and classification. The priority here is that any system goes beyond subjective opinions – and their often binary approach, using yes/no flagging. Firms need to adopt a comprehensive framework for classification built around circumstances, severity and coping mechanisms. This should also include support needs – and the relevant tracking, to identify any support offered and what success it achieved. Firms should also ask if any system is capable of recognising a person’s multiple, overlapping vulnerabilities – or managing customer vulnerability across groups such as households – two key developments added this year to the MorganAsh Resilience System (MARS).

Next is data protection – which remains a hot topic. Can a system store data securely, with appropriate encryption and suitable compliance with GDPR? While concerns are fair, this has long been many firms’ scapegoat (and get out of jail card). However, dedicated systems not only provide a high-level measurement of vulnerability – such as the MARS Resilience Rating – which can be shared across the distribution chain, they also keep data secure, accurate, readily available for access requests and filtered based on role or need.

Thirdly is lifecycle management – which gives firms the ability to record data, and changes in data, over the lifetime of products and services. Not only is this critical in understanding how circumstances have changed, it ensures that firms remain alert – particularly if systems can prompt for scheduled reviews based on risk and product type.

Fourth is meaningful reporting – aggregating data across vulnerability cohorts and trends over time to recognise gaps in identification, outcomes and the effectiveness of intervention. Combine this with the final point – a clear audit trail – and these key components can put that vital intelligence in the hands of firms to ensure that reporting and compliance isn’t a mad scramble or a shot in the dark.

Seizing the opportunity

This comprehensive checklist is not made of up ‘nice-to-haves’ but essential components for any customer vulnerability management system that is genuinely up to the task. While it may all sound onerous, leveraging the right technology enables firms to streamline processes, drive efficiencies and unlock significant intelligence – transforming customer vulnerability from being just a compliance commitment into a strategic opportunity.

For too long, the conversation has been all about the stick, rather than the carrot, and that has not helped. Through our own platform MARS, we have seen firsthand that businesses have embedded the Duty’s principles, embraced the technology and are reaping the commercial benefits. With this checklist, there is no reason why more firms shouldn’t join them on this journey.

Pivotal CII guidance on customer vulnerability management

The Chartered Insurance Institute (CII) and Personal Finance Society (PFS) have been beavering away for much of this year on something which we think is one of the most useful customer vulnerability tools since the TEXAS mnemonic.

Every so often, a customer vulnerability initiative comes along which really moves the dial.

The Chartered Insurance Institute (CII) and Personal Finance Society (PFS) have been beavering away for much of this year on something which we think is one of the most useful customer vulnerability tools since the TEXAS mnemonic (a framework for having sensitive conversations), which was created in 2019 and is now widely used.

It’s a new guidance paper, called ‘Supporting vulnerable customers: a practical guide for insurance and personal finance firms’, which is designed to help firms in the insurance sector take the principle-based guidance of Consumer Duty and turn it into a practical action plan.

It’s true that a lot of firms and professional bodies have published their takes on Consumer Duty, but much of this simply rehashes what is in the FCA’s regulations without adding anything new – other than perhaps some clarity. Or, the guidance focuses on one specific topic, such as training, or research, and doesn’t address managing vulnerable customers in a holistic way.

Papers from professional bodies can have a bit of a rep for being ‘guidance handed down from on high’ by non-practitioners, but this paper has been extensively researched and contributed to by Consumer Duty experts, customer vulnerability experts and firms in the sector. It’s also been extensively peer-reviewed, including by the FOS and FCA. It has also received input from many people with lived experience of vulnerability.

So, what’s different about this paper?

It’s practical: it helps firms go from principle to practice.

It’s written by specialists who have walked, or are walking, the customer vulnerability journey.

It avoids repeating information that is already out there.

It focuses on foundational topics which are important to get right first, if you’re going to avoid expensive wrong turns – by having an objective, nuanced, vulnerability classification lexicon, which is then translated into a data structure that is not only useful it is also scalable and sharable.

It looks across the whole vulnerable customer journey, not just a part of it.

As one of the UK’s customer vulnerability thought-leaders, MorganAsh is proud to have been one of the contributors and reviewers – working alongside some great professionals in the field and in the insurance sector.

And, while it’s written for the insurance sector, there is little in the guidance that isn’t of value to other financial services firms.

As I’ve said, the guidance is practical, and one of the document’s golden threads is that of data: structure, classification, privacy and so on. While this isn’t an especially sexy topic, it’s the one which I’ve seen most companies get fundamentally wrong – leading to some very expensive wrong turns. Indeed, a lot of vulnerability customer initiatives haven’t taken this fully into account, which means some considerable unpicking later.

If you don’t have the right data structure, absolutely everything else doesn’t work, or takes far too long, costs too much money, or leads to significant issues with reporting, managing vulnerable customers over time and providing evidence to the regulator. Without good data, you don’t have an accurate fix on which customers are vulnerable and in what ways, you can’t help them, you can’t spot issues and rectify them, you don’t have information to help design products and management information is flaky at best.

We are massively supportive of the CII guidance and we urge everyone with a customer vulnerability remit to read it. It will be a great help to you. I’m also open to conversations about it, as I’m sure is the CII. Get in touch for a chat after you’ve read it.

You can download it here.

Customer vulnerability management system selection checklist

When considering what technology to adopt, this checklist should help assess whether systems meet the requirements for effective customer vulnerability management.

Every firm is on a unique journey with its customer vulnerability management strategy, which translates into different levels of operational maturity. This checklist should quickly pinpoint areas for enhancement and support the assessment of current capabilities against good practice. When considering what technology to adopt, the following checklist should help assess whether systems meet the requirements for effective customer vulnerability management.

This checklist was created by the Chartered Insurance Institute; reproduced with permission.

Contact us for a chat if you want to explore these topics and see how to identify, manage, and support vulnerable customers more easily, cheaply, and efficiently using a powerful digital system.

Identification and classification

Are there proactive and reactive methods to assess and identify the customer’s vulnerability characteristics?

Is there a classification system or taxonomy that records vulnerabilities in an objective way (not just a binary yes/no) so that data is consistent and excludes the recording of subjective opinions.

Are the correct data elements (as per Section 5.2.4 Data structures) in place, including circumstances, severity, coping mechanisms, support needs, the support implemented and the resulting outcomes?

Can the system document the impact of multiple and overlapping vulnerability circumstances?

Is the system designed to capture and manage customer vulnerability across groups (mostly family groups)?

Data protection requirements

Can it store data securely with appropriate encryption and access controls?

Can it record the rationale for processing the data (for example, consent, legitimate interests)?

Can it modify, update and delete individuals’ data in line with data subject rights?

Can it provide information to the customer (from subject access requests) in accessible formats?

Does it have mechanisms to keep data both accurate and up to date?

Does it cater for only the appropriate personnel to access data, limiting access to those who need it?

Does it support role-based access in a tiered way (e.g. front-line staff see basic flags; specialists see full details etc)?

Lifecycle management

Can it record data and changes in data over the lifetime of products and services, for example, whether circumstances have improved, worsened or remained the same?

Does it support automated alerts when vulnerability circumstances change or require review?

Can it prompt for scheduled reviews based on risk and product type?

Can it integrate with customer communication systems to prevent inappropriate contact?

Does it suggest next steps or support needs based on identified vulnerabilities?

Can it record whether the customer adopted the recommended support or not?

Reporting

Can it aggregate data by vulnerability cohort for outcome monitoring?

Can it track trends over time (for example, identification rates, outcome gaps and intervention effectiveness)?

Audit trail:

Does it capture a complete history of all changes (i.e. who, what, when, why)?

Can it demonstrate regulatory compliance through evidence trails?

Customer vulnerability data framework checklist

Use the following checklist to assess or build a vulnerability data framework. This checklist should quickly pinpoint areas for enhancement and support the assessment of current capabilities against good practice.

Every firm is on a unique journey with its customer vulnerability management strategy, which translates into different levels of operational maturity. This checklist should quickly pinpoint areas for enhancement and support the assessment of current capabilities against good practice. Use the following checklist to assess or build a vulnerability data framework.

This checklist was created by the Chartered Insurance Institute; reproduced with permission.

Contact us for a chat if you want to explore these topics and see how to identify, manage, and support vulnerable customers more easily, cheaply, and efficiently using a powerful digital system.

Foundations

Data quality: is there a process to maintain the accuracy of core customer contact information over time?

Classification: is there a firm-wide, objective taxonomy for classifying customer vulnerability characteristics and severity?

Data model and systems

System capability: can the IT systems store, link and analyse key data components (for example, circumstances, severities, potential harms, support pathway and outcomes)?

Household view: can systems link individuals to form a family or household unit or view?

Combination of circumstances: do our systems show when multiple circumstances of vulnerability are compounding, to make customers’ situations worse?

Governance and policy

Data policy: is there a clear policy on storing underlying circumstances, severities, and support needs, as well as when support needs were implemented?

UK GDPR compliance: is the lawful basis for processing customer vulnerability data documented? Are security and governance measures robust and compliant with UK GDPR?

Customer vulnerability management checklist

Every firm is on a unique journey with its customer vulnerability management strategy, which translates into different levels of operational maturity. This checklist should quickly pinpoint areas for enhancement and support the assessment of current capabilities against good practice.

Every firm is on a unique journey with its customer vulnerability management strategy, which translates into different levels of operational maturity. This checklist should quickly pinpoint areas for enhancement and support the assessment of current capabilities against good practice.

This checklist was created in partnership with, and published by, the Chartered Insurance Institute; reproduced with permission.

Contact us for a chat if you want to explore these topics and see how to identify, manage, and support vulnerable customers more easily, cheaply, and efficiently using a powerful digital system.

Strategy, governance and culture

Target market analysis: clearly defined and quantified characteristics and scale of vulnerabilities and their impact or consequences (for example, the potential harms) that the customer base and target market face.

Policy: a policy which defines the data needed, where it is stored, how it is kept both accurate and consistent, and when it is to be deleted (all in accordance with UK GDPR).

Product design: product design, approval and review processes consider the needs of vulnerable customers in order to prevent foreseeable harms and ensure fair value.

Systems and processes: systems and processes manage the data required for customer vulnerability management.

Staff training: training ensures that all relevant staff (from front-line teams to product teams and senior leadership) are trained, empowered, competent and confident to understand the needs of, and support of, customers in vulnerable circumstances.

Culture: led by senior management and the board, firms can evidence an organisation-wide culture which prioritises delivering good outcomes for vulnerable customers.

Identification and recording

Proactive identification: proactive processes identify customer vulnerabilities across the entire customer journey, rather than rely solely on customer disclosure at any single point (for example, claims or complaints stages).

Holistic assessment: assessments cover the full range of vulnerability drivers (e.g. health, life events, low resilience, low capability etc.) and their potential to intersect with other vulnerabilities (not just financial vulnerabilities).

Consistent recording: a taxonomy to consistently record all vulnerability related data and its potential impact.

Protected characteristics: systems that allow firms to monitor outcomes for customers with protected characteristics, in line with the Equality Act 2010.

Action and support

Tailored support: firms can demonstrate how they use customer vulnerability data to provide tailored support and inform product design.

Consumer understanding: firms should test and adapt customer journeys to ensure that those customers with diverse needs can easily navigate them.

Accessible journeys: firms have review and. remove unnecessary friction (‘sludge’) in customer processes that create barriers or harm for vulnerable customers.

Monitoring, reporting and assurance

Quality data and evidence: a data architecture that delivers consistent data and allows firms to evidence the steps taken, and the outcomes achieved, to accommodate each customer over the lifetime of products and services.

Outcomes monitoring: firms can report on the outcomes experienced by vulnerable customers compared to non-vulnerable ones in Consumer Duty Board reports – and can compare outcomes between different cohorts of vulnerable customers (for example, those experiencing a specific negative life event, who have a type of low resilience) and between a specific cohort of vulnerable customers and non-vulnerable ones.

Assurance and testing: a regular assurance programme (for example, call monitoring, case file reviews or mystery shopping) can test whether vulnerability policies are followed in practice.

Distribution chain oversight: monitoring and governance extends across the entire distribution chain to evidence good outcomes across it (this requires data sharing).

Is Consumer Duty really at risk?

The Chancellor Rachel Reeves has stated her intention to cut red tape in the financial services sector to help accelerate economic growth. She has called regulation the “boot on the neck” of businesses – signalling a desire to move to a leaner and less risk averse approach to oversight.

The Chancellor Rachel Reeves has stated her intention to cut red tape in the financial services sector to help accelerate economic growth. She has called regulation the “boot on the neck” of businesses – signalling a desire to move to a leaner and less risk averse approach to oversight.

In particular, the Chancellor has called for the FCA to review Consumer Duty and its impact on wholesale firms – and, in the process, has stirred up speculation about its future. It seems that some in financial services heard the Chancellor’s comments about deregulation and Consumer Duty and jumped to completely the wrong conclusion.

For those yet to fully embrace Consumer Duty, or unlock its competitive and commercial advantages, it is simply wishful thinking. Rather than at risk, Consumer Duty is here to stay and remains the cornerstone of the FCA’s entire regulatory approach.

Geared for growth

The launch of Consumer Duty marked a pivotal milestone in a 10-year project, moving financial services away from prescriptive tick-box regulation towards a principles-based approach focused on increasing trust and improving customer outcomes. That flexibility allows for growth, all while ensuring that consumers remain protected.

Not only are there good reasons behind it, but the benefits for consumers and firms are enormous. What better way to drive sustainable growth in the sector and the wider economy than by increasing trust and improving customer confidence?

While Reeves certainly generated headlines, we need to do more than jump at snippets. Her review focuses explicitly on the impact of regulation on wholesale firms, rather than consumer-facing firms or sectors.

In reality, the FCA has reaffirmed its commitment to Consumer Duty. It has issued Section 165 data requests to financial advisers to understand how the Duty is being embedded. In its latest report, the Financial Services Consumer Panel has also emphasised the importance of the Duty in driving better outcomes and holding firms to account. All the while, the regulator continues to publish thematic reviews across all different sectors, with each built on the foundation of Consumer Duty. Through all the above – and more – it’s clear Consumer Duty is the lens through which the FCA is assessing firms across the sector.

The bigger issue

The entire conversation speaks of a much bigger issue where there are still so many firms that are miles off in their adoption or embracing the cultural change the regulator wants to see. Firms that hope the Duty will be softened or shelved risk falling further behind, both in terms of compliance and because their competitors continue to realise the opportunities that Consumer Duty presents.

There are also firms which have the best intentions and appreciate the purpose of Consumer Duty, but are struggling in their implementation. In particular, the Duty has placed renewed emphasis on good outcomes for vulnerable customers. The FCA has encouraged firms to engage directly to identify who those customers are, monitor the outcomes they receive and reduce potential harm, and this is proving to be the hardest part of Consumer Duty.

The FCA’s recent multi-firm vulnerability review identified that firms still cannot effectively monitor or take action on outcomes for vulnerable customers. In separate research, it found that many firms are reporting few or zero vulnerable customers, which is simply not plausible. The Financial Lives survey says that nearly half of all UK adults have one or more vulnerability – so logic dictates that, at a basic level, firms should report somewhere near that proportion.

The technology gap

When I hear firms reporting such low vulnerability, it screams a lack of quality data. Consumer Duty is heavily reliant on robust data to understand, monitor and report on segmentation, fair value and customer outcomes. With the right technology in place, firms can implement the correct processes and generate the necessary data to not just comply with Consumer Duty, but to improve and personalise their service to best support customers.

We are firm believers that the process starts with an objective and consistent approach to vulnerability assessment. Making this process digital and accessible drives engagement, while the objective nature of the output means the data can be trusted. An assessment completed through the MorganAsh Resilience System (MARS) for example generates an objective Resilience Rating, which is best described as being like a credit score for vulnerability.

Generating results

In just two years, those firms which have embraced Consumer Duty are already reaping rewards. It goes far beyond staying out of trouble with the regulator. While that is undeniably important, it also enables firms to deliver a better, stronger and more personalised service. We are seeing examples of businesses unlocking real commercial benefit – all by leveraging the vulnerability data they generate. In one case, it has allowed a firm to launch new and highly-targeted products and make better lending decisions.

This isn’t the exception, it is quickly becoming the norm. Firms are delivering better outcomes, improving retention and nurturing stronger relationships. These are far from signs of a regime that holds businesses back – they are signs of a healthier market.

As with other regulated firms, we believe it is essential that regulation is proportionate. We also shouldn’t view Consumer Duty as the finished article. It has to develop, adapt and improve to ensure it remains aligned with the needs of the market and in the best shape to support consumers. While Rachel Reeves may want a regulatory environment that encourages growth and innovation, it doesn’t need to come at the cost of consumer protection. Far from simply coexisting, they go hand in hand.

From crisis to opportunity: a new era for vulnerable consumers

Johnny Timpson OBE’s keynote speech from Utility Week Consumer Vulnerability & Debt Conference 2025 on 18 September 2024.

Johnny Timpson OBE’s keynote speech from Utility Week Consumer Vulnerability & Debt Conference 2025 on 18 September 2024.

Hello, good morning and I add my own welcome to today’s Utility Week consumer vulnerability and debt conference.

I’m Johnny Timpson and, in addition to information about me in the bio provided by our hosts, I additionally chair essential regulated sector vulnerable customer support specialist MorganAsh and sit on the TrustMark warm homes scheme consumer protection panel. I have spent over twenty-five years liaising between charities, consumer groups, self-help groups and government bodies to improve consumer understanding, access, inclusion, value, service and support – plus, importantly, working to ensure that vulnerable consumers enjoy the same outcomes as anyone else.

My remarks today will focus on our need to be smarter and more joined-up on regulatory policy and practice, along with data-sharing – all to improve vulnerable customer interventions and support – together with the need to be passionate and hold ourselves, as vulnerable customer support professionals, to account in doing so.

With Ofgem announcing a 2% increase in the energy gap from October 2025, and the regulator’s refreshed consumer strategy now live, with a broader update on the regulator’s debt strategy awaited, our coming together here, today, to discuss and share how we can improve both the identification of, and support for our vulnerable customers is timely – with the need to be both innovative and proactive in delivering tailored solutions and support more pressing than ever.

The urgency is underlined by Uswitch saying that the UK is in an energy debt crisis; the average arrears for a gas and electricity customer is now over £1500 – this is where there is no time to pay arrangements in place and is only slightly less than this where there is.

On top of this, GPs and medical professionals in primary care, the gateway to our NHS, report that around 23% of their caseload – and increasing – is either caused by, or compounded by, financial health issues such as “how do I pay my gas/electricity bill and still meet my rent and other bills?” I took the very same social prescribing course as GPs, who told me that they feel more like advisers on debt, welfare benefit, housing, energy, water and finance as opposed to being medical professionals.

It’s past time for all of us in essential regulated sectors to realise, and respond to, the fact that when we fail our vulnerable customers, their support needs remain; this drama then becomes a multi-agency and pan-regulated sector crisis – with our NHS increasingly having to pick up the pieces.

I warmly welcome the leadership that is being taken by Ofgem and the Financial Conduct Authority – and that this has been stepped up over the last two years. This is particularly true since, in my experience, and no matter the sector, regulation is always playing catch-up when we are seeking to protect consumers from foreseeable harms. Therefore, regulation should be the beginning of our help for vulnerable customers, not the extent of it.

There is both a need and a commercial benefit to going beyond what regulators want – and to provide better and more targeted support. Let’s not kid ourselves, at the moment essential regulated sectors don’t do this particularly well – and we struggle to even identify those customers in need of support. On top of that, we make it difficult for those with support needs to engage with us. This, despite the fact that energy bills and billing have been with us since 1883!

I’m delighted to see Ofgem acknowledge that strides have been made in data-sharing, particularly between energy and water firms. This said, we need to go much further and far faster. For me, and for my colleagues across essential regulated sectors, who assisted the development of the recently published Money Advice Trust’s data-sharing principles, we should strive for a common vulnerable customer definition, lexicon, red flags and staff training. It’s great to see Ofgem, the FCA and Ofwat in this space, calling on Government – and other parties – to discuss on how this can be done.

The increasing needs of our vulnerable customers, and the regulations to help support them, spring from customers being exposed to foreseeable harms: customers in crisis; customers receiving ‘bad outcomes’ or being treated unfairly. Back in 2013, Ofgem was the first regulator to recognise the growing vulnerable customer support need – with the financial services sector quickly following – and, whilst today essential regulated sector firms are responding, we must challenge ourselves and ask: does our response go far enough – and are we missing what could be a significant opportunity to make a difference?

What does this ‘opportunity’ look like in practice? How do we move from simply identifying a vulnerable customer, to providing a truly segmented, personalised, meaningful and sustainable solution – supported by understandable communication and inclusive engagement channels?

Let’s consider a common and difficult scenario in the energy sector: an elderly homeowner, perhaps living, like me, with a disability – who is in fuel poverty. They are asset-rich, having owned their home for decades, but cash-poor; they may be getting Warm Home Discount, a warm homes local grant or WaterSure support. They face the daily, stressful dilemma of choosing between heating and eating. They don’t know what to do, who to turn to, are scared of being scammed – and, as a consequence, seek support from a trusted source … hence the growing financial worries and stress caseload experienced by GPs.

The current approach is fragmented. Consumers are stuck – like a pinball in a bewildering maze of different organisations, having the same stressful conversations over and over. The data is siloed, and so are the solutions.

This is where the real opportunity lies: an opportunity to build a more holistic and supportive ecosystem.

Imagine if, with the customer’s explicit consent and control, we could securely link the data from their energy account with anonymised data from their financial and property assets. This isn’t about sharing data for its own sake; it’s about using it to be proactive – and to unlock a profoundly better outcome.

It would allow us to architect entirely new and innovative solutions. This could, for example, be a smarter and tailored time to pay, or a properly regulated financial instrument that empowers that homeowner to use a small fraction of their housing wealth to create a dedicated, ring-fenced ‘energy guarantee’. Or perhaps a protected fund that automatically pays their energy bills directly to the supplier – and the capital for the solar panel installation.

For the consumer, the benefits are transformative. Their fear, anxiety and distress are reduced and hopefully completely removed. Their dignity is preserved, and they can stay warm and safe in their own home.

For the utility provider, this is a game-changer. It moves beyond the endless cycle of forbearance and debt collection. It creates a secure, predictable payment stream, reduces arrears, and forges a genuinely positive, long-term relationship with the customer.

This is the very essence of what the UK Government and regulators are looking for: market-based innovation that provides more personalised, more sustainable, and more dignified outcomes than simply ticking the ‘meeting the regulations’ checkbox. This is what it means to truly move from crisis to opportunity: using data to build bridges between sectors – and create holistic solutions that empower consumers and change lives.

We need to use customer vulnerability data in a much more meaningful way – simply mining data to identify all those over the age of 65 may meet the PSR’s regulatory target – but it is a long, long way from where we can get to. AI both offers, and is giving us, fantastic opportunities, although yes – it must be used cautiously. Andrew Gething, my CEO from the digital vulnerability management firm MorganAsh, coined a saying: “If Amazon did vulnerability, they would call it personalisation”. This perfectly captures the opportunity of vulnerability. For example, firms are now using the personal profile information captured for vulnerability to power personalised AI-driven phone calls – massively reducing the prohibitive cost of agents chasing debts.

And, ever mindful of Uswitch’s energy debt insight and call to action, I look forward to Ofgem’s broader debt strategy update – and 100% agree on the need for further consultation on the following:

Improving customer trust and engagement, to ensure better support and debt outcomes for individual customers and for the sector – particularly where customers are vulnerable and facing hardship.

Ensuring a controlled, consistent and compassionate approach to credit – and the exploration of differing payment methods, plus reviewing how and when financial support should be offered to customers.

Tackling system inefficiencies and incentives to ensure that consumers are both supported and encouraged to pay their bills – plus improving relationships with debt advice agencies, with this critical to developing and delivering affordable repayment plans.

This echoes what is going on in the FCA’s regulated sector – notably around payment arrangements – and the water sector under Ofwat. We all recognise that the need for debt advice is growing – as is its funding – and I’m supportive of the call made in July by Clear Consultancy Services for a better funding model and new legislation to deliver it in the form of a debt funding bill.

While it is with good intentions that Ofgem and now Ofwat require the PSR, I hold that it is both far too simplistic and binary to provide meaningful data on consumers –and simply acts as a flag for further engagement. Digital vulnerability management systems now cover over three times the characteristics of the PSR – with nuanced ranges for severity of each characteristic, not just binary flags. There are systems in the marketplace – yes, from small innovative companies – that help with signposting to multiple firms, not just a handful of partners. Open Banking gives us access to transactional data and the pension dashboard coming soon will enable us to locate lost pensions more easily.

Hesitancy about GDPR, and that consumers will not provide the required data, is unfounded. I spoke with the ICO – and their overriding comment is they don’t want to stop anyone sharing data needed to help vulnerable people. Yes, there may be some technicalities to work through, but these are being worked on and will be resolved.

As utilities providers, you have a captured market, consumers have to work with you – financial services would bite off their right hand to have this type of access to consumers.

So, this is my ask of you, my call to action.

Vulnerable customer support colleagues, I ask you to share thinking and learning about what works, and what doesn’t, both with the delegates at today’s conference and your colleagues in the workplace. Let’s pledge to make a real difference for our customers.

We live in a digital world. Let’s manage our relationships and interactions better – and that’s with allcustomers not just the 50% who are vulnerable. Think about how you can engage with customers better by sharing data with other parties – with their consent, for their benefit. Grasping and making the most of this opportunity starts with good quality current personalised customer data – not a PSR tick-list.

Thank you.

Understanding the vulnerability gap

How many vulnerable customers should a firm expect to have? The FCA’s Financial Lives survey reports that around 50% of people will be vulnerable at any one time. This seems like too many. Many firms still report single-figure proportions of vulnerable customers, sometimes as low as 1% or 2%. This seems far too few. Why is there such a difference? Why do many firms report such low numbers, and does it matter?

Understanding the vulnerability gap

How many vulnerable customers should a firm expect to have? The FCA’s Financial Lives survey reports that around 50% of people will be vulnerable at any one time. This seems like too many. Many firms still report single-figure proportions of vulnerable customers, sometimes as low as 1% or 2%. This seems far too few. Why is there such a difference? Why do many firms report such low numbers, and does it matter?

Comparable studies from related organisations also back up the FCA’s 50%, though it may seem high. Many of that 50% will be mild vulnerabilities. Based on live assessments from a wide range of firms across multiple sectors, MorganAsh’s data shows that the proportion of vulnerable customers requiring action can typically be expected to be around 10%–15%.

With reported figures ranging from upwards of 2% and the FCA setting expectations of there being around 50%, the shortfall is often huge. Let’s look at why there is such a gap.

The most significant issue is that most firms are working reactively – only checking whether customers are vulnerable when the customer contacts them. This is just a fraction of the total number of customers. Firms aren’t identifying their vulnerable customers, they only identify those they speak to, or who contact them during claims or complaints journeys.

Many vulnerability issues encountered are overcome by staff, informally, at the time of interaction. While providing responsive support is good, the vulnerability is automatically deemed to be overcome – and is often not recorded, even if it continues to be an issue, or is something which could worsen later.

There is a reluctance to record customers’ vulnerabilities at the point of sale, because of a concern that it may interfere with the sales process.

Firms and staff feel that it could be embarrassing to ask personal questions.

It may be believed that the consumer is reluctant to disclose issues which are considered private, or firms worry that customers fear that their information could be misused (or used to make negative decisions) or lost/stolen.

The vulnerabilities may be mild and not warrant any change to a process; firms therefore feel there is no need for them to be recorded.

All of these factors compound, resulting in firms only identifying a small proportion of vulnerable customers. Let’s look at each in turn.

Reactive-only approach: the problem with this is that firms rely on the consumer contacting them; in practice, an ever-increasing number of interactions are digital and transactional, so there is little opportunity for disclosure. Also, the consumer is usually unaware that there is any need to disclose vulnerability information to the firm (and they may also not consider themselves vulnerable or understand what a vulnerability is or isn’t). In some cases, customers may have disclosed but the information was not recorded. Where firms are proactive, and engage with all or most of their customers over time, the percentage of identified customers goes up. This works best when done at an existing point of engagement, for example at the point of sale, at a review or when a claim is made and so on – it can become a natural part of that customer journey.

No need to record a vulnerability: if it was overcome: there are three issues with this approach. First, there is no evidence for audit purposes that the vulnerability characteristics were considered; second, if a different product or circumstance comes into play in the future, where the vulnerability is relevant, there will be no record; and third, there is no comparison data for Consumer Duty outcome reporting – to demonstrate, when comparing outcomes, that the vulnerability was considered and overcome.

Fear of affecting sales: a common fear within commercial teams is that asking personal questions will be considered invasive and affect a sale. We have yet to find any evidence of this; indeed, we have evidence that an improved understanding of consumers’ personal situation leads to increased engagement and sales. This fear is natural but unjustified.

It’s embarrassing to ask personal questions: many people find that asking personal questions is embarrassing and are reluctant to do this. This is understandable, if only because it is a change. All of our experience is that, once you try, there is not an issue. It is ironic that our national greeting is “how are you?” – a question about health; many people find talking about money to be impolite, yet financial services firms do this every day. This is simply an issue of getting used to change. MorganAsh has assessed vulnerable people for over twenty years and this is very seldom an issue.

Reluctance to disclose: this is often quoted as the major issue by those who have not yet implemented a vulnerable customer strategy. It is true that a few consumers may not want to disclose all the information, but our practical experience is that they will if asked, or at least disclose enough to be useful. It is important to explain to consumers why the information is required, so they can understand the benefits of doing so.

The vulnerability is not important enough to be recorded: there are many issues that are relatively mild and common – for example, partial hearing loss. Such vulnerabilities do not require any adaption and are often judged to not be important enough to label the person as vulnerable. Our challenge here is that, (as with not recording vulnerabilities when overcome) we need evidence to demonstrate that the vulnerability was considered; we also need data for outcome reporting – and, if the vulnerability changes or progresses, what was once a mild issue could become acute (if we have recorded this, we can prepare for it).

Another factor is that many of the firms identifying vulnerable customers in single-percentage figures do so because their clients are wealthy or financially secure – not financially vulnerable. Other vulnerabilities need to be identified, because money does not provide immunity from health issues and life events.

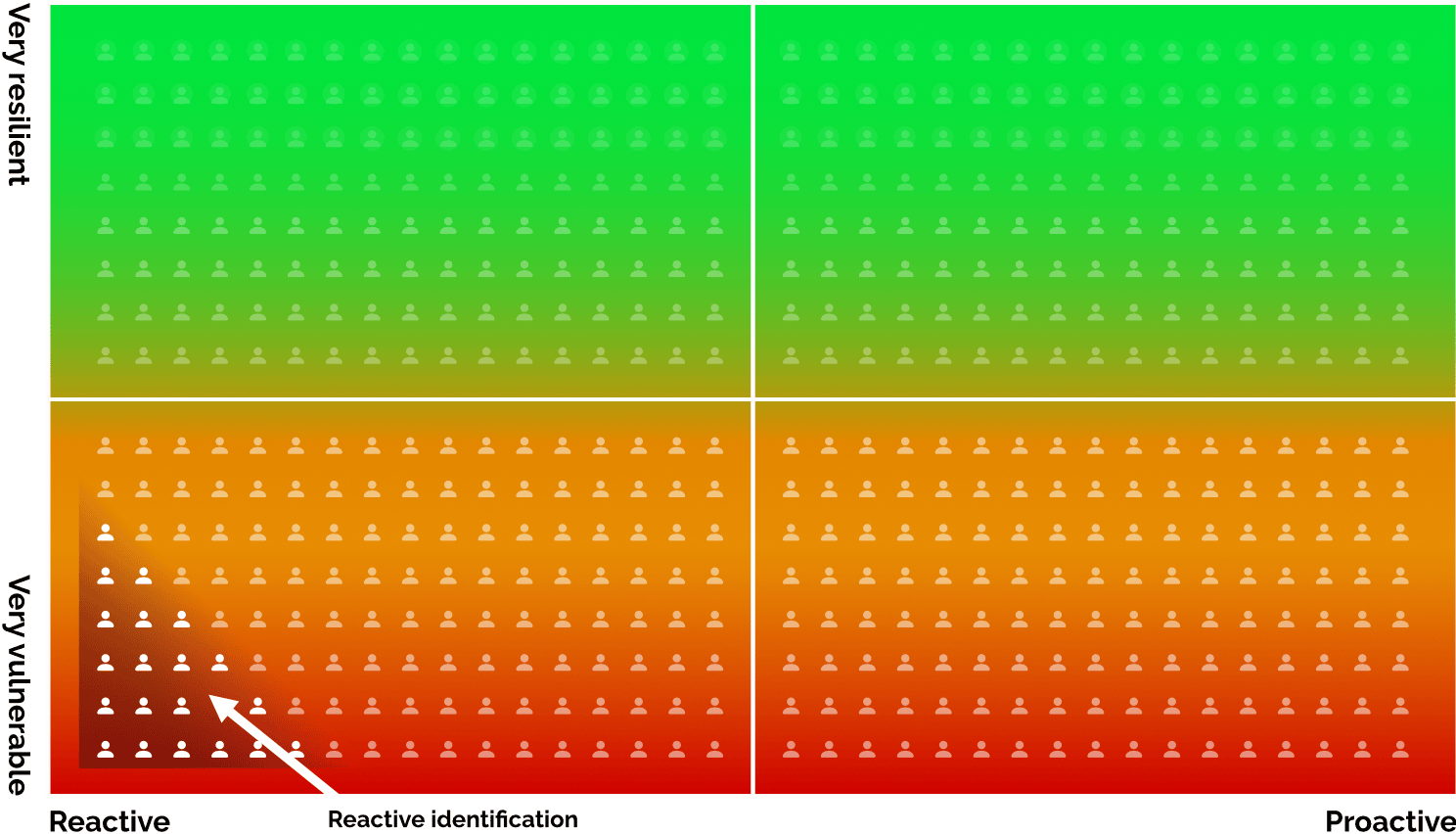

The graph above shows how only a subset of vulnerable people are identified when the firm works in a reactive way (denoted by the strong white dots at the bottom left); in reality, anyone in the red area will be very vulnerable and need action or support, and anyone in the orange area may have a mild vulnerability which doesn’t require action but it should be recorded and reported on.

An identification gap of between 2%–50% may seem insurmountable but, in reality, the steps needed to move towards more accurate identification are neither complex nor hard.

While organisations can address these issues themselves, technology such as MARS (the MorganAsh Resilience System) already exists to provide a digital, low cost, easy-to-manage solution – one which can be adopted within days, if needed. It can operate fully digitally or within an agent/adviser-guided workflow.

Working proactively, recording not only vulnerabilities but also any mitigation strategies, support offered/taken and support outcomes, overcoming cultural or familiarity hurdles and changing the nature of the vulnerability categories recorded can shift the dial massively on your identification levels. This spills quicky into offering better support, delivering better outcomes, having better management information and being able to easily report to the regulator.

The gap is real – but the target percentage isn’t that difficult to achieve. And one thing is certain, if you think you only have a few per cent of vulnerable customers, you are almost certainly wrong – and a good data-driven process can show this.

Consumer Duty two years on – are we closer to the change the regulator wants to see?

July marks the second anniversary of Consumer Duty, the FCA’s tentpole regulation designed to set higher standards for financial services and drive better customer outcomes.

July marks the second anniversary of Consumer Duty, the FCA’s tentpole regulation designed to set higher standards for financial services and drive better customer outcomes. Two years on, some firms have seized the opportunity to stay closer to clients and made good progress in better understanding their needs and tailoring service to deliver better outcomes.

By contrast, there are still firms which are behind the curve, whether it’s in complying with the Duty and getting to grips with principle-based regulation, or the wider expectation to embed these principles into business culture, governance and leadership. Complacency remains a big issue as firms overlook the step change required to meet the FCA’s expectations.

Consumer Duty remains the cornerstone of the FCA’s entire regulatory approach. Even with a remit of deregulation, the FCA views Consumer Duty as the principal way to drive growth and innovation in the sector. So, whether firms like it or not, Consumer Duty is here to stay. With two years under our belt, how can we deliver the change the regulator wants to see?

Customer vulnerability

One of the biggest areas for improvement is customer vulnerability. In its recent multi-firm vulnerability review, the FCA identified that firms still cannot effectively monitor or take action on outcomes for vulnerable customers. This is hardly surprising; identifying vulnerable customers has long been considered the most difficult aspect of Consumer Duty.

Although we are all vulnerable at some point in our lives, many firms still report very few, or zero, vulnerable customers. This just isn’t realistic – especially when the FCA’s Financial Lives survey found that 49% of UK adults have one or more characteristic of vulnerability.

Part of the problem is many firms’ reactive approach – waiting for consumers to tell them of their vulnerabilities, or focusing on just a subset of their customer base – or one channel, such as claims or complaints. While this is a good place to start, it doesn’t give firms anything like the full picture. To reach that true proportion, the FCA has repeatedly said that firms need to “actively engage” with consumers; this is still proving to be a real stumbling block for many.

A lack of quality data

Whether it’s ignorance or a piecemeal approach to engagement, firms inevitably become data-poor – unable to demonstrate fair value, good outcomes or wider compliance with the Duty. The FCA has seen examples of some firms repackaging existing data without really thinking about the information needed to truly understand outcomes.

Our experience is that by engaging directly with all consumers using a vulnerability assessment, firms can acquire the robust data needed to not just identify their vulnerable customers, but to monitor and report on the outcomes that customers receive. Crucially, these assessment methods have to be consistent and objective to generate the quality of data needed.

As data standards improve, we can look at data sharing across the distribution chain – this would bring new levels of efficiency to Consumer Duty and allow us to truly put the customer first. The entire process would finally become joined-up – and far smoother for consumers as they share their information once for all parties to act upon in a consistent way.

Technology is available

The regulator knows that firms face an arduous task, which is why it has long advocated for technology adoption to help meet the requirements. Rather than adding nondescript tick boxes to CRMs, or expending both time and money of developing systems in house, firms can use one of the many digital platforms already available to overcome these key challenges. In the two years of Consumer Duty, these systems continue to not only get better but also lead the way in what’s possible.

Technology plays a critical role in bringing consistency not only to assessments but also to how information is collected, standardised and recorded. Just as important is objectiveness; this cannot be achieved through human decision-making – however well trained, advisers, agents and frontline staff will always be subjective. Our MorganAsh Resilience System (MARS) for example, uses assessments which automatically produce an objective Resilience Rating, which is much like a credit score for vulnerability.

Technology has to be the priority for financial services firms in year three. Not only does it drive efficiencies, it brings consistency, scale and cost savings which cannot be achieved through a manual approach or training.

The future

Given the recent focus by the government on deregulation to stimulate economic growth, Consumer Duty has found its future in the spotlight. The Chancellor’s recent Mansion House speech saw some in the industry taking her comments out of context – and thinking it’s all over for Consumer Duty.

The shift to principle-based regulation and a focus on outcomes is a significant move. It ensures consumer protection while also providing flexibility for growth. It’s a forward step, yet it’s almost as if firms want to go back to the prescriptive tick box regulation of old.

Firms which have not embraced Consumer Duty and vulnerability management underestimate the value and growth opportunities which will spring from increasing consumer trust in financial services. Much of the talk so far has been less about the carrot and more about the stick – and this is not helpful. In our corner of the market, we see tangible examples of real commercial benefits for firms – not just from delivering a more personalised service – but leveraging the vulnerability data they generate to make better lending decisions and ultimately launch new and highly-targeted products.

There will always be those bemoaning the regulation and looking to slash what they perceive as red tape. I firmly believe that, as Consumer Duty continues to develop, we see more examples of commercial gain and better customer outcomes – and the Duty deniers will either retire or be late to the party once they realise what they’ve been missing.

Data-sharing isn’t just good for customers – it’s what they expect

As part of Consumer Duty, the FCA asks for firms to consider not only their actions, but also those of other firms across the value chain. One way to achieve this, perhaps the simplest, is to share the individuals’ data. However, many firms don’t recognise the need to do it; some believe this it would be against GDPR or that consumers wouldn’t like it.

As part of Consumer Duty, the FCA asks for firms to consider not only their actions, but also those of other firms across the value chain. One way to achieve this, perhaps the simplest, is to share the individuals’ data. However, many firms don’t recognise the need to do it; some believe this it would be against GDPR or that consumers wouldn’t like it.

Consumer Duty is about putting the customer first – and not only is sharing the required data a simple, pragmatic solution to “work together across distribution chains to deliver good outcomes” (FCA: ‘Consumer Duty implementation plans’ 21 Jan 2023 – 6.4) it is also likely to be what customers expect.

Let’s look at each of these elements.

It is true that Consumer Duty itself doesn’t include a specific requirement for firms to share data, but the FCA does expect firms to work together: “In particular, manufacturers and distributors will need to work together and share information. To help ensure this happens, we have set a milestone for the end of April 2023 for manufacturers to complete all reviews necessary to meet the four outcome rules and share information with distributors to allow them to meet their obligations.” (FCA: ‘Consumer Duty implementation plans’ 21 Jan 2023 – 6.4) While ‘share information with distributors’ may not point specifically to consumer data, it would seem more than useful for others in the supply chain to be aware of any vulnerabilities, in order to avoid harms. Indeed, a great deal of Consumer Duty will run more smoothly if this is done.

It also avoids the consumer being asked time and again for the same information – in itself, this is not a ‘good outcome’ and can be a frustrating and stressful experience if someone is vulnerable.

Then there is data privacy (“GDPR doesn’t allow us to do this”). The privacy pushback simply isn’t true. Yes, data must be collected and stored in accordance with GDPR, but GDPR doesn’t prevent it. Indeed, in our conversations with the ICO, its view is that they would not want GDPR to in any way interfere with or subvert customers’ rights or needs.

In reality, what’s happening here is a mixture of misunderstanding of GDPR and firms’ information systems not supporting the secure sharing of data. Bearing these in mind, it’s possible that some pushback is based on avoiding what needs to be done to make it happen. Data-sharing can be granular – with the right systems, not all data needs to be shared, just enough to enable decision-making or reporting. When GDPR is cited as a reason for not sharing data, it feels hard to challenge – but in many cases it is that the systems in use are unable to share the right data, securely – it’s not GDPR itself.

Which brings us to ‘customer ownership’ – we don’t want to share the data because this is ‘our’ customer’. This strange phrase is accepted almost universally by everyone – well, everyone except customers themselves, who simply do not like the idea that they are in some way ‘owned’. Of course, the desire to hang on to hard-won customers is understandable, but it’s also questionable if doing so in itself creates an avoidable harm – which, like using GDPR as an excuse, is highly probable.

What is almost never discussed is what the customer’s views are.

Well, that’s not entirely true. When customers are polled for views on privacy, they understandably want it respected. The problem is that questions can be loaded. Ask anyone, “do you want us to share your information with anyone else?” and the answer will generally be no. But if we were to ask such questions in context, then the answer can be different. For example, “To make sure that we’re providing the right products and services, and that you are not exposed to risk, it’s helpful to share your information with companies providing this service – is this OK?”

We also need to consider that when a customer buys a product or service, they don’t see the entire supply chain. To them, it’s simply one transaction or service. When they buy insurance from a broker, they don’t expect to have to deal with anyone else – they expect everyone involved to know what needs to be known. Other information gets passed up and down the supply chain, no problem – so why not this? The customers’ expectation is that this is one transaction or service, whatever happens behind the scenes. Indeed, customers would likely be horrified to find that information about themselves is not shared by those working together to provide a product or service.

If something is relevant in any way to their situation or what they are buying, they would expect everyone involved to know, surely?

Like many things in business, it’s about putting the customer first. It’s hard to see how requiring customers to provide the same information again and again – and perhaps get different outcomes from different parts of the value chain – does this. Nor would it be what the customer wants or expects.

When it comes to supporting vulnerable customers, technology plays a critical role in delivering positive outcomes. It enables firms to implement consistent and objective assessment methods to generate an unbiased measure of consumers’ vulnerability and capture the quality of data required for consistent reporting.

Using the MorganAsh Resilience Systems (MARS) as an example, our assessments produce a Resilience Rating, which is much like a credit score for vulnerability.

Not only can this objective measure be shared across the value chain to ensure consistency and avoid assessment fatigue, it provides a top-level indication of vulnerability without sharing extensive personal data – meeting the GDPR principle of data minimisation.

How underwriting needs to change to meet Consumer Duty

Pension annuities have been in the doldrums for many years but are now on the increase. This is due to improved rates and, with changes to pension taxation, they are arguably likely to increase further. Annuities providers turned their attention to bulk annuity contracts with defined benefit pension schemes and this market continues to grow. However, little has changed over the last ten years in terms of retail consumer products and processes. We ask: what needs to change in light of Consumer Duty?

Pension annuities have been in the doldrums for many years but are now on the increase. This is due to improved rates and, with changes to pension taxation, they are arguably likely to increase further. Annuities providers turned their attention to bulk annuity contracts with defined benefit pension schemes and this market continues to grow. However, little has changed over the last ten years in terms of retail consumer products and processes. We ask: what needs to change in light of Consumer Duty?

Reinsurers tell us that around 60% of consumers receive ‘standard’ annuity rates – with no uplift because of health issues. This is alarming, because this figure should be more like 20–30%. Simplistically, it shows that around a third of customers receive lower annuity rates than they could qualify for. Clearly, this cannot be defended as a good outcome.

To understand the dynamics of this, we need to look at the processes. To obtain an enhanced rate for their annuity, providers need to understand the consumer’s medical history. This is almost always undertaken using an industry-standard medical form, which must be completed by the adviser, the consumer or a third-party specialist nurse assessor. Unless the assessment is undertaken by a nurse, it is fraught with challenges.

Consumers generally downplay their medical issues; advisers find it embarrassing and don’t really want to pry into clients’ medical conditions; providers earn more if they receive less information – and are more efficient if they can automate the underwriting process. Each party in the distribution chain will say they play their part – providers give the best quote on the information they receive, while advisers say they fill in the form as requested, and consumers don’t appreciate that worse health can be financially beneficial. Consequently, poor medical information is given, evaluated, and results in lower annuity rates being offered – reinsurer data indicates that this affects about one-third of consumers. This is an industry systematically delivering poor outcomes.

At MorganAsh, our annuities quotation service includes a medical assessment, by a nurse, to get good medical information – and it often unearths more material information than any standard application form. Repeated surveys of our work show that this process directly returns higher annuity rates for 76% of customers – with a mean increase in annuity rates of 2.5%, compared to completing the standard online application form.

Consumer Duty requires us to put in the same effort into delivering good outcomes for consumers as we do to generate sales. Annuities use a standard application form, followed by automated underwriting based on this standard form. In contrast to protection underwriting, protection underwriting demands more medical information, more rigorous verification, and a balanced use of automated and manual underwriting, depending on risk level. The standard application form makes it easier for advisers to get comparative quotes.

The last regulatory intervention promoted competition, and comparative quotes with the aim to improve outcomes, however, this has not improved outcomes as much as hoped.

Another major issue is if or when annuities are considered. There are multiple pros and cons as to whether an annuity should be used. It is generally accepted that they be part of retirement advice. As consumers’ health generally declines with age, then arguably an annuity should be considered as part of any retirement plan – if not every year, then at least every few years, or when health issues change.

Since health is a major component of the annuity rate, a robust health assessment should be undertaken every few years. Comparing standard annuity rates is only going to understate the real rate for at least two thirds of consumers. However, most annuity quotations are obtained at retirement age, indicating that annuities are only being considered at that age and not being compared through retirement.

The elephant in the room is the commercial bias for assets under management (AUM). Investments earn annual advice and management fees, while an annuity releases a one-time commission. AUM is the main method to value advice firms, and therefore, there is strong commercial pressure to keep consumers’ funds under management – and not release them to annuity providers. With so much acquisition and consolidation in the market, it is difficult to believe that this does not have an impact on decision-making.

Logically, those with health issues (the vulnerable) will receive poorer outcomes, because they get lower annuity rates than they are entitled to. Consumer Duty’s outcome reports should measure good or poor outcomes for retirees. It is highly unlikely though that the consumer will understand if they received a lower annuity than they deserve and are therefore unlikely to complain. To understand, firms will need to review consumers’ health, to determine if they could have received a better outcome; this may need to be built into current quality checking to avoid increased overheads.

No doubt firms will aim to identify these issues within their Consumer Duty board reports and will be putting in place the measurements needed to understand consumer outcomes for the vulnerable. I’m sure that to change some of these processes will require cross-industry changes, which will take time.

Closing the loop on customer vulnerability with support tracking

One of the first hurdles to overcome for any firm on its customer vulnerability journey is the actual identification of vulnerable customers. This is by no means a small feat, as many firms have found out when trying to meet the requirements of the FCA’s Consumer Duty.

One of the first hurdles to overcome for any firm on its customer vulnerability journey is the actual identification of vulnerable customers. This is by no means a small feat, as many firms have found out when trying to meet the requirements of the FCA’s Consumer Duty.

It’s important to also note that, while significant, it is just one responsibility that makes up a firm’s wider customer vulnerability management strategy. Once we have identified our vulnerable customers, it is followed by the challenge of what do we do next – and the support we recommend. We know that we need to provide support – to enable clients to achieve a good outcome – but to really understand the outcomes clients receive, we need to look beyond purely ‘signposting’ or making an initial recommendation. We need to look at the complete picture.

Alongside recording the recommendations made, and how these were made, we also need to note whether it was suitable, and also whether it was taken up and implemented by the client. Without understanding and tracking this critical stage, we risk undoing all the important work done earlier in the process – identifying, classifying and monitoring potential vulnerabilities – and risk delivering a poor outcome by not knowing where the failure point is.

For example, many firms will recommend that consumers set up a will and a lasting power of attorney – but the take-up rate for these can be low, resulting in poor outcomes. In this instance, the identification of the vulnerability is very high – not having a will in place – but the implementation of getting the will is the thing to break the chain.

Just recently, a probe by the FCA revealed that some banks and building societies needed to provide greater support to those dealing with a bereavement or setting up a power of attorney. The regulator found examples where individuals were unable to access funds because staff were unsure of which action to take, or how quickly.

It quickly becomes clear that tracking suggested support is just as important as making the recommendation in the first place. After all, it is this which allows firms to keep track of what happens with the individual and ensures that interactions with clients are appropriate. Furthermore, the record of suggested support becomes hugely valuable for audit purposes, allowing firms to report on the support actions consumers take up and implement. It goes without saying how important this is in demonstrating compliance with Consumer Duty.

In truth, we need to understand and track all stages of customer vulnerability management, as any one of these can fail. This starts with identification and classification – understanding who has what –and to what severity – before we even move onto monitoring. Then we can recommend and track support pathways. Following this, we can monitor outcomes far more closely to determine whether a poor outcome was mitigated.

Without robust data at every stage, it becomes much harder for firms to really know what is going on with clients and to accurately pinpoint where any failure point is. The FCA has consistently reminded firms just how important good data is in managing customer vulnerability and for meeting the requirements of Consumer Duty. The latest example was in its multi-firm vulnerability review which identified that many firms are still unable to monitor or take action on outcomes for vulnerable customers.

There’s no question that this is an onerous task. The FCA is fully aware of this and has long advocated for the use of technology to help firms meet the requirements. Digital platforms – such as the MorganAsh Resilience System (MARS) – are now available to not just help with the assessment, but also to make recording and tracking information at every stage much easier.

MARS, for example, offers a catalogue of standard pathways – the ‘next steps’ presented to users when a characteristic of vulnerability is detected. In our latest software update, we’ve added the ability to record how and when suggested support is recommended to clients, along with their reactions – and whether they take-up the recommendations. There is also the ability to record if support is pending, partially completed or not implemented, as well as if it’s incorrect, not required or declined by the consumer, with notes available to add for all progress.

We know that most proactive advisers will want to go the extra mile and support clients at the time of need with relevant recommendations. Given the scope of the potential next steps available – including mitigating strategies, support organisations and charities – covering a spectrum of potential vulnerabilities of varying severities, this can be easier said than done. Add in the need to record, track and report on all this information and there’s no question that a digital-led approach enables firms to actually achieve this – moving from simple signposting to a recommendation strategy that is targeted, can be monitored, is data-rich and always audit-ready.

Will commission survive the FCA’s pure protection review?

Recently, the FCA published the terms of reference for its review of the pure protection market, following consultation on the review’s scope and approach. While many of those who are tired of being ‘bundled in’ with general insurance welcome this market study, the elephant in the room is commission – or, to be more specific, commission bias.

Recently, the FCA published the terms of reference for its review of the pure protection market, following consultation on the review’s scope and approach. While many of those who are tired of being ‘bundled in’ with general insurance welcome this market study, the elephant in the room is commission – or, to be more specific, commission bias.

For years, consumer groups have cited commission bias as a major cause of consumer harm. The industry’s position is that because life insurance is not that stimulating to purchase, without commission, sales will drop and the proportion of protection provided will plummet – which is not good for the nation’s financial resilience. Fundamentally, both arguments are true.

The challenge for the industry is how it can reduce bad outcomes which result from commission bias, and evidence this – so it does not get strangled by a blunt regulation. The industry needs to demonstrate that commission bias is just a minimal cause of bad outcomes.

Consumer Duty gives the financial services industry the framework needed to measure and report on bad outcomes for all consumer types. Ideally, firms would demonstrate the effects of commission on consumer outcomes, across different distribution models – although, as most firms have a single remuneration model, this may not be possible.

Recent attention has been on claims and claims turnaround times and, as claims is where the value of protection insurance is received and demonstrated, it deservedly gets this attention.

20 years ago, MorganAsh introduced tele-interviewing to the UK. The key benefits of this were to separate the medical assessment from the sales process and to be more diligent in collecting medical information. Now, the amount of misrepresentation we see that results in paid-out claims is effectively zero (we do get some fraud by consumers, but this is quickly and easily debunked at the time of claim).

The industry chose a different route, pursuing automated systems and requiring the salesperson to undertake medical assessments – all in the pursuit of sales, which were prioritised over reducing misrepresentation and any resultant problems at claim stage.

Statistics on declined claims due to misrepresentation have improved over the years – but this is due to cases being paid out rather than up-front identification. Reinsurers report misrepresentation in around 10–20% of cases – and they maintain that the industry could reduce its fees if misrepresentation was reduced.

Under Consumer Duty, it is difficult to justify consumers paying a premium resulting from an industry focusing on sales rather than consumer outcomes. There is a difficult fair-value argument, which says that consumers pay more because the industry is focused on sales – and indeed, this is exactly what Consumer Duty is trying to change.

We know consumers believe that pay-out rates from protection insurance are far lower than they are in practice and, despite good PR and marketing efforts, this has hardly changed over the last 20 years. The industry’s focus is on sales, not consumer outcomes, – and it only needs a few bad stories (justified or not) to reinforce the consumers’ view. After all, bashing the insurance industry drives both views and clicks.

Consumer Duty’s main thrust is for firms to focus on good consumer outcomes or, at the least, reducing bad outcomes, as this will improve consumers’ trust over the long term. Improving trust over the long term should improve consumer take-up and sales, so it is in both the consumers’ and the industry’s interest.

When remunerating by commission to an individual, and requiring them to undertake the medical assessment, it is difficult to even suggest that bias does not exist. In addition, undertaking medical assessments and selling/advising on products typically requires radically different skill-sets, and is generally an inefficient use of advisers’ time.

Using techniques like tele-interviewing to separate sales and medical assessments not only removes bias, but provides the evidence of having removed bias. It seems to me carrying on denying that there is an issue with commission bias, without any evidence to demonstrate this, is not going to wash. Firms need to prove to the regulator that there is no commission bias – and demonstrate the removal of bias to win back consumers’ trust.

Top 10 pitfalls made by firms when implementing customer vulnerability

Customer vulnerability is like any journey. Set off with the wrong destination in mind and that’s where you’ll end up – the wrong place. Many firms succumb to the same pitfalls when setting out on their customer vulnerability journey – and then find they are adrift in terms of outcomes, customer support, reporting and compliance. With the FCA announcing the findings of its vulnerability review, we look at the ten most common pitfalls.

Customer vulnerability is like any journey. Set off with the wrong destination in mind and that’s where you’ll end up – the wrong place.

Many firms succumb to the same pitfalls when setting out on their customer vulnerability journey – and then find they are adrift in terms of outcomes, customer support, reporting and compliance.

With the FCA announcing the findings of its vulnerability review, we look at the ten most common pitfalls.

Some firms assume or believe customer vulnerability is all about (or mostly about) financial vulnerability; some even say that their clients are too wealthy to be vulnerable. Customer vulnerability characteristics also include things like health and lifestyle. Wealth isn’t a shield against many vulnerabilities.

Some firms think that vulnerability is binary – a yes or no – when there is a range of severities and impacts. Someone isn’t just vulnerable or not, in the same way that people aren’t rich or poor, or sighted and blind.

Some firms wait for consumers to inform them of any vulnerabilities, when the FCA has said that firms should actively engage with all customers. People are unlikely to proactively disclose such information, sometimes because they worry it will be used against them, sometimes because they don’t see themselves as being vulnerable and often because they aren’t aware of Consumer Duty.

Some firms restrict vulnerable customer processes to those involving human interaction or phone calls – ignoring digital and other forms of consumer interaction. All forms of interaction should be included.

Some firms identify and mitigate customers’ vulnerabilities but fail to evidence having done this. This could be because such work is undertaken informally; it could be because there isn’t a structured way to report such interactions – and therefore no way to report on them.

Some firms place most of their focus on training front-line staff, expecting them to both be able to identify all vulnerabilities, and remember the multitude of ways their firm can mitigate issues – and expect this to happen without any system support. This places what are quite detailed and specialist tasks into the hands of staff who are already busy performing their core roles, expecting the overhead to be ‘absorbed’. Results from this approach have been shown to be poor.

Some firms rely on and accept individual subjective customer vulnerability assessments, despite evidence which shows that lack of awareness, training, professional empathy or having conscious or subconscious bias can skew results, making them inconsistent and possibly opening the firm up to legal action. Firms fail to introduce an objective methodology of communicating the wide variations in impact of each vulnerability characteristic, resulting in poor, inconsistent data that cannot be understood by others.

Some firms fail to consider the FCA’s requirement for ongoing monitoring and the need to record customers’ vulnerability characteristics over time, especially over a product’s lifetime.

Some firms fail to consider how to communicate customer vulnerability characteristics between intermediary and manufacturer – they may be doing it inadequately, doing it inconsistently or assuming the other is doing it – and therefore not doing it at all.

Some firms fail to consider how customer vulnerability data can be collated and compared to outcome data – to enable reporting on vulnerable cohorts.