Reporting on vulnerable customers

MARS provides always available, rich management reporting – just a couple of clicks away – plus detailed monthly reports and customer resilience certificates.

“The MARS vulnerability report provides valuable live data as to whether a client will get health-rated for life insurance and/or permanent health insurance. It also allows vulnerability tracking throughout the conveyance – which is vital under Consumer Duty.”

— Sam Whybrow CFP AFPS RLP, Chartered Financial Planner

Details matter. Little things can make big things happen.

Because MARS collects data in a sophisticated and detailed way, it can provide customer vulnerability reporting on another level.

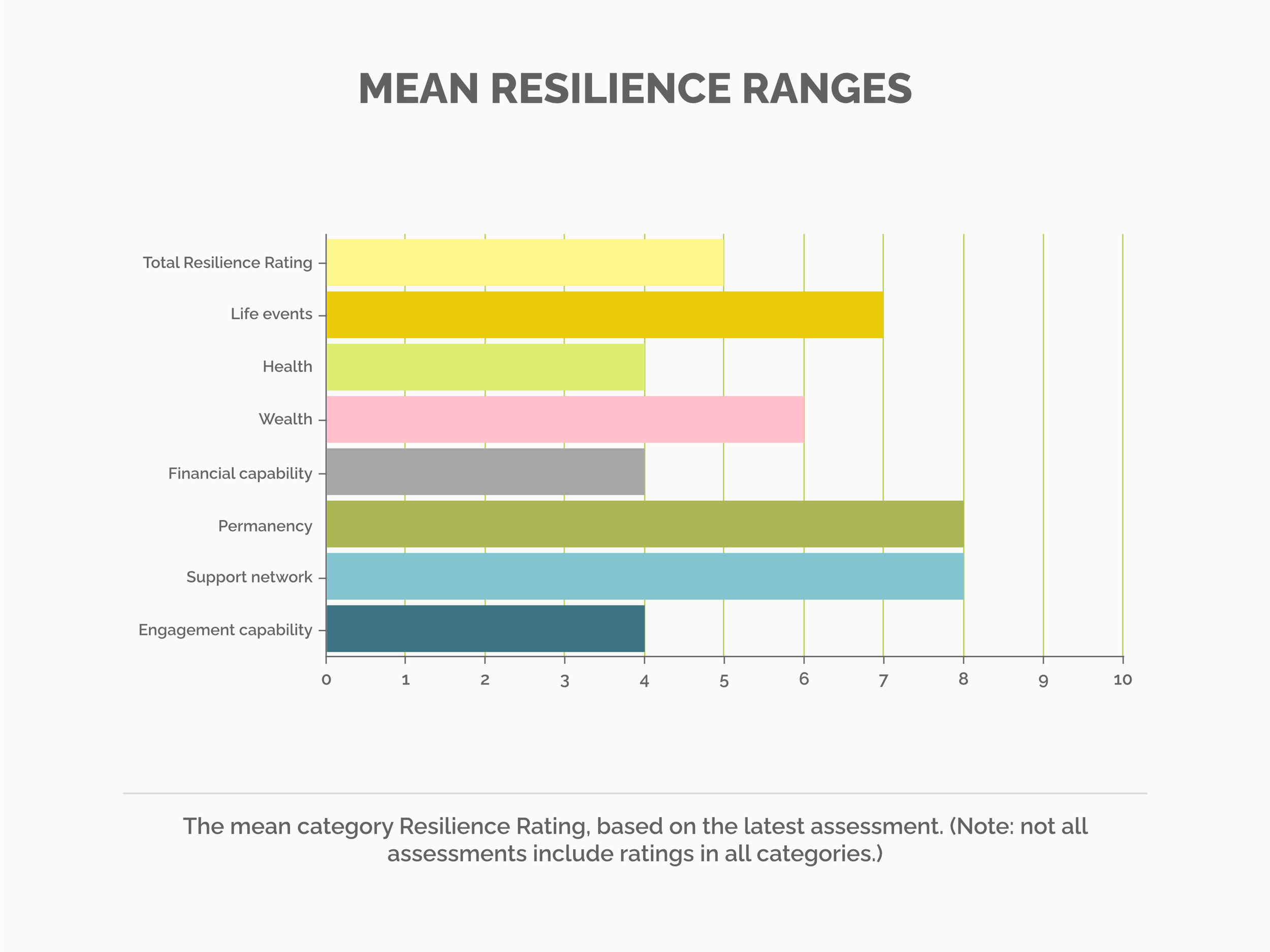

Reports are always available, and users can drill down into data for specific vulnerability characteristics such as physical and mental health, wealth, life events (such as bereavement or divorce), the ability to understand financial conversations, the ability to engage and the person’s support network.

This enables firms to identify vulnerable cohorts and address any shortcomings – improving customer service, products and communications. The data is also suitable for both board reports and for regulators.

All MARS customers receive detailed monthly reports and individual resilience certificates are always available for all consumers.

Of course, we don’t know how you will use your data – but what we do know is that, without data, what you can do is limited. With good, solid, detailed and accurate data, you can improve and differentiate products, services, communications – and more.

Financial firms – reporting for Consumer Duty

Under Consumer Duty, financial firms need to report on the outcomes of vulnerable cohorts compared to the resilient. MARS collates all the individual data so reports can be provided for Consumer Duty reporting for the FCA.

Utilities firms – reporting for PSR for Ofgem

MARS provides a PSR output for each consumer – and can provide collated reports by area and region, for reporting to Ofgem.

MARS contains a powerful reporting suite, enabling you to quickly access a comprehensive range of information across a wide range of customer vulnerabilities.