A comprehensive consumer vulnerability management system

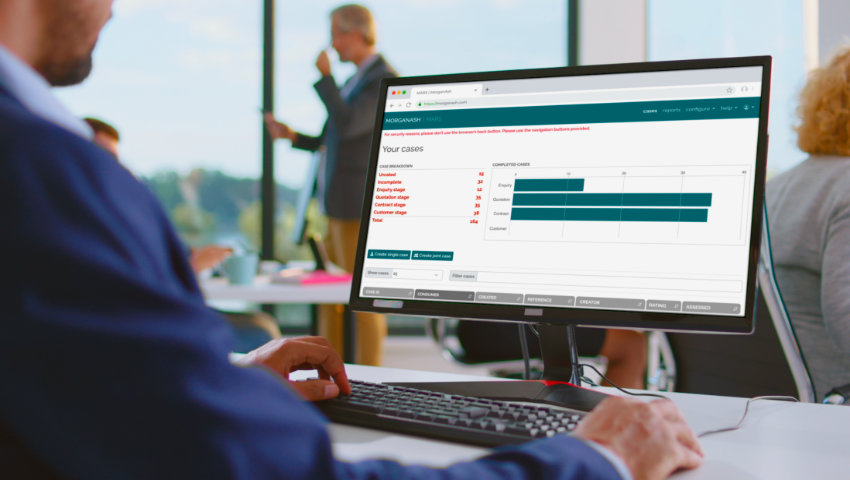

There is an increasing need for organisations to understand their consumers – and to record any actions taken to ensure good, fair outcomes. The MorganAsh Resilience System – MARS – is an easy-to-use, award-winning, online system which enables them to accurately assess consumers’ characteristics and identify any potential harms – and then recommend appropriate actions to mitigate those potential harms in a consistent, structured way. It enables firms to demonstrate compliance with the FCA’s Consumer Duty and Ofgem’s vulnerability requirements. read case studies

MARS largely automates the assessment of vulnerable consumers, generating (without intervention or guesswork) an objective, consistent ‘Resilience Rating’ – like a credit score. MARS also helps to determine next steps needed to mitigate any potential harm. This is all supported by on-demand human services (provided by a team of fully qualified nurses) to help with more difficult assessments – and to provide additional services which support vulnerable consumers.

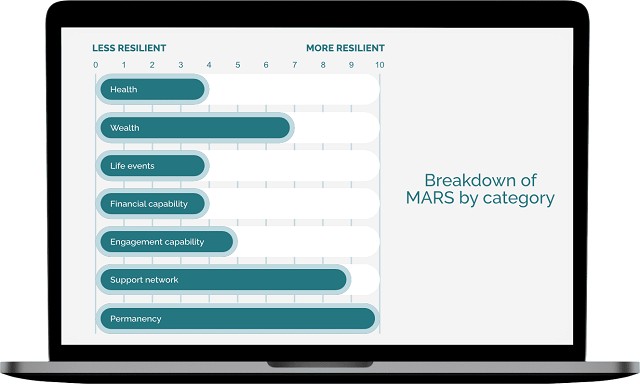

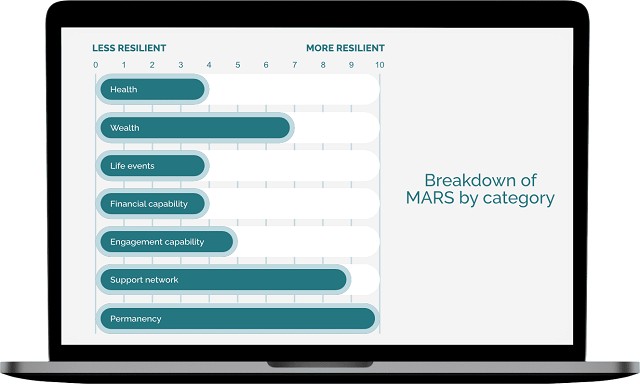

MARS assesses a range of vulnerability characteristics including health, wealth, lifestyle and support network to derive an objective assessment of consumer resilience.

Features

- Winner – National Credit Awards 2023: Fintech and Platform of the Year.

- Holistic assessment criteria, covering relevant characteristics, including: health, wealth, lifestyle and support network.

- Determines consumer characteristics by direct input, online assessment (emailed to the client), look up of the VRS (Vulnerability Registration Service) or an independent interview by MorganAsh nurses.

- Calculates an objective measure of resilience/vulnerability – ‘the MARS Resilience Rating’ – enabling detailed reporting to meet Consumer Duty’s evidence requirements for management – including support for fair value and target market analysis.

- The ability to monitor changes in circumstances and characteristics over time – MARS is a ‘lifetime’ system.

- Highly flexible and configurable – can be adapted to meet the precise needs of any organisation. This includes assessment criteria, detailed assessments, ‘next step triggers’ and more. It is in use in the financial services and utilities sectors.

- An extensive library of treatments, which are ‘next steps’ suggested when a vulnerability is discovered, is built into MARS.

- A comprehensive range of statistical data, benchmarks and management reports is always instantly available – helping businesses to plan, respond better and easily demonstrate compliance.

- APIs (application programming interfaces) enable integration with standard and bespoke CRM systems, and the real-time transfer of consumer information, to avoid double-handling of data.

- Underpinned by a team of fully qualified nurses, to provide expert human help and assistance whenever needed.

Benefits

- Demonstrable compliance with the FCA’s Consumer Duty and vulnerability regulations.

- Saves users a significant amount of time, without adding compliance overhead – we can demonstrate a 6:1 return on investment.

- Improves understanding of consumers, enhancing engagement.

- Lifetime data, to monitor changes in vulnerability over time and across transactions.

- Enables cross-department and cross-company communications, by managing the complexities of vulnerabilities – and presenting them as a simple to communicate Resilience Rating – just like a credit score.

Vulnerability isn’t binary

Vulnerability isn’t a yes or a no. Many people can be classified as vulnerable – and for many, their vulnerability is invisible. Many current means of assessing vulnerability are simply too superficial and, most importantly, don’t bear regulatory scrutiny. That’s why MARS has a sophisticated rating system and algorithms which take a comprehensive range of factors into account. Yet, when MARS has done its work, it provides the easy-to-understand ‘Resilience Rating’ – like a credit score. It’s simple, fast and objective. Plus, it encompasses a comprehensive range of potential vulnerabilities.

Free trial

You can try a complete, unrestricted version of MARS for a full month, free of charge. Simply request access our trial system to get started.

Find out more

Downloads

We have two pricing tiers, delivering different levels of functionality. Our pricing model is simple: for smaller adviser firms, we charge per adviser; logins for administrators and paraplanners are free. For larger firms, manufacturers, lenders, product providers and utilities companies, fees are per customer per annum, based on volume.

- Online and adviser assessments

- Calculated resilience rating

- Vulnerability report per assessment

- Up to 10 cases per month

- Consumer and user assessments

- Calculated Resilience Rating

- Vulnerability report per assessment

- Management reports

- Logos on consumer communications

- Customisable treatments

- Configurable messages in consumer communications

- Up to 20 assessments per month

- Choice of online, user or nurse assessments

- Calculated Resilience Rating

- Vulnerability report per assessment

- Management reports

- Integrations via API to other systems

- Logos on consumer communications

- Configurable messages in consumer communications

- Customisable treatments

- Each consumer checked on VRS - Vulnerability Registration Service

- Up to 40 assessments per month

Sign up for free access

You can try a complete, unrestricted version of MARS for a full month, free of charge. Simply request access to get started. We’ll be in touch and help set up MARS in the way that works best for you. After one month, we will automatically begin invoicing you. If you have questions, just get in touch with us – we’ll be happy to help resolve any queries.

- Full access to all features

- No limit on number of users

- No limit on number of administrators

- We’ll help get you started

Sign up for a free trial

We will contact you to get your trial period started and to setup MARS. We will begin invoicing you at the end of your trial period. Costs will be discussed and confirmed with you in advance.

We’re here to help

If you need help to get started or to resolve any queries, please let us know. We’ll be happy to help.

We’re here to help

If you need help to get started or to resolve any queries, please let us know. We’ll be happy to help. We want to make adopting MARS as easy and effective as possible. This can encompass onboarding just the MARS system, or helping your organisation to understand and implement greater organisational support for interacting with those consumers who have vulnerabilities.

Fitting in with current processes

Although MARS is designed to be quick and easy to implement, it may need customising to fit in with your process and systems. Talk to us – and we will guide you through configuration options, system integration capabilities and how others are using the system.

Support to get you going

Adopting any new system, adding new business processes, or changing the way in which you interact with customers and vulnerable people can take time and require help. We want you to make a success of using MARS and, for financial services firms or those providing finance offerings, we can help you meet the FCA’s Consumer Duty and Vulnerability regulations. Every organisation is at a different stage on this journey, so we can work with you – by understanding where you are now, and helping you adopt MARS as part of a vulnerability consumer strategy.

Integration

MARS is designed to integrate with other systems, such as CRM applications, via APIs. Priority of integration is determined by demand. If you need MARS to integrate with other systems, then please contact us so we can help you.

Treatments – what to do next and when to provide additional support

Built into MARS are dozens of treatments, which are ‘next steps’ you may decide to take when a vulnerability is discovered. This enables organisations to help the customer quickly and easily. Like much of MARS, treatments can be configured to meet each organisation’s needs. We work with customers to understand when it is appropriate to add additional services and when it is not. This is always in line with organisations’ conduct risk policies, compliance with the Equalities Act – and financial and customer service criteria.

For help using MARS, or integrating MARS with your current systems, please contact us. We’ll be happy to help.

| InstallationHow do I install MARS? |

MARS is software as a service, accessed via any standards-compliant Web browser. No installation is required. This allows you to access MARS from almost any device and almost any location. An internet connection is required.

|

| Help with the trialWhat if I need help to find my way around? |

MARS is designed to be simple and straightforward to use, so we encourage you to dive in and use it. If you’d like a guided tour, or some help, please contact us.

|

| SecurityHow secure is MARS? |

MorganAsh is an ISO 27001-certified company – this is an international standard for managing information security. MorganAsh is also a Cyber Essentials Plus-certified company – the highest level of certification offered under the Cyber Essentials scheme. All client/consumer data is kept secure on our bespoke systems.

|

| RegulationHow is MorganAsh regulated? |

The collection of consumer characteristics, assessment of potential harms and ongoing monitoring is, under Consumer Duty, a regulated activity. To comply with this, MorganAsh is authorised and regulated by the Financial Conduct Authority (No 451227). The specific permissions covered are (for both insurance and investments): arranging (bringing about) deals in investments; assisting in the administration and performance of a contract of insurance; making arrangements, with a view to undertaking transactions in investments. Full details can be found on the FCA register.

|

| ComplianceWhat about data protection? |

MARS is fully compliant with GDPR. MorganAsh is responsible for the storage and deletion of all data in accordance with GDPR, and for recording consumer consent where electronic assessments are used. Organisations and their users are responsible for obtaining the requirement for the data and obtaining consent and for the storage and deletion of any downloaded reports.

|

| CustomisationWhat happens if MARS doesn’t quite meet our needs? |

For those organisations whose needs are not met by MARS, our system is designed to be extensible and customisable. Feel free to contact us about your specific needs.

|

| IntegrationCan MARS talk to our other systems? |

Our API enables integration with other systems. Current integrations include Intelliflo and Iress. We are extending this in line with demand. Other integrations are available on request.

|

| Why MorganAsh?What are MorganAsh’s credentials? |

MorganAsh has enviable experience assessing consumers’ health and lifestyle characteristics, via clinical and cognitive assessments, since 2004 – for the financial services sector. We have assessed the health of thousands of consumers and looked after hundreds of severely ill consumers. We combine bespoke systems with empathy-driven clinical expertise, to deliver award-winning services. Since our formation in 2004, we have had few Financial Ombudsman Service complaints and zero found against us. There has never been an event reported to the Information Commissioner’s Office. Our customer complaints record is exemplary with only four complaints in the last three years.

|